- Tour

Who We Serve

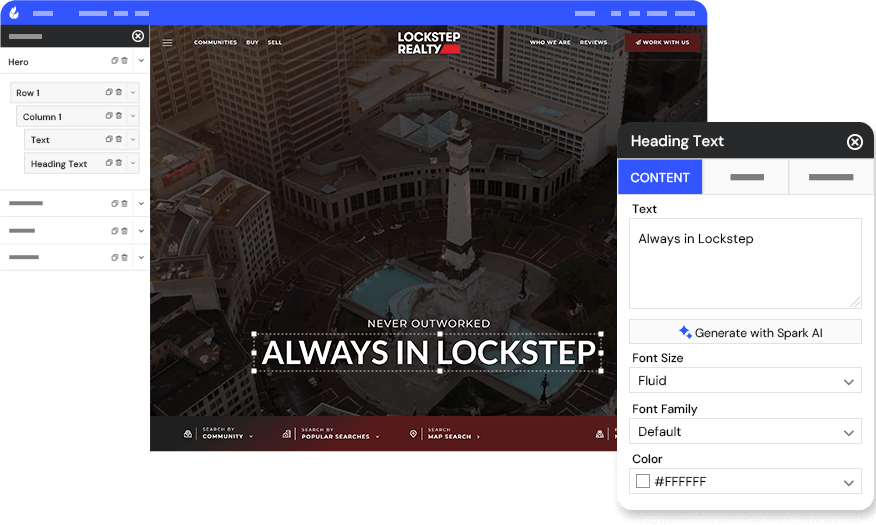

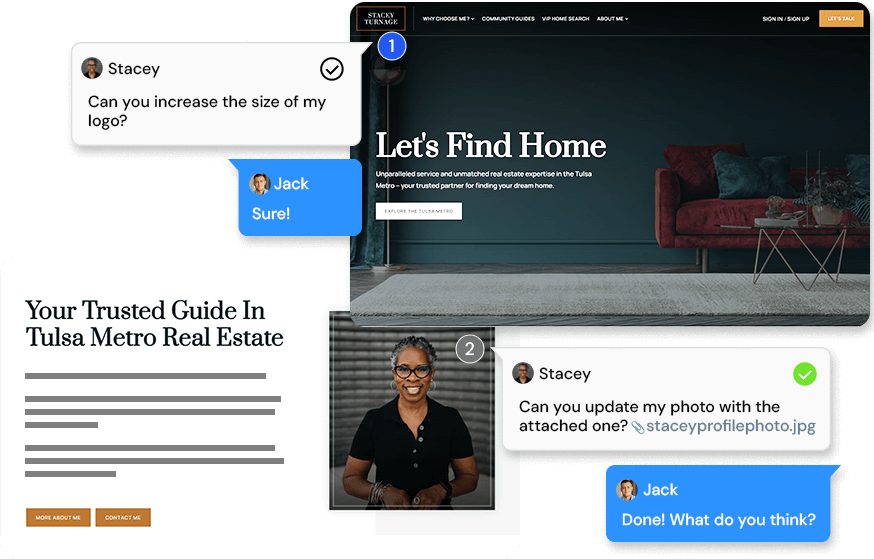

Agents

Build Your Brand. Showcase Your Value. Grow Your Business.

Teams

Unify Your Team. Amplify Your Impact. Grow Your Business.

Marketplace

Unlock premium addons for design, branding, content, SEO and more!Integrations

Browse trusted experts for PPC, CRM, SEO and more!

- Work

- Partners

Affiliate Program

Earn recurring monthly commissions for life for each referral that signs up!

Refer a Friend

Earn a FREE month for each friend who attends a demo, no purchase required!

- Pricing

- More